Turn your financial dreams into reality with guarantee of Pramerica Life Signature Wealth

UIN:140N091V02

Pramerica Life Signature Wealth, is a simple yet powerful solution to fulfil your financial goals and provide financial security to your loved ones. This Plan eliminates the uncertainties and provides a guaranteed safety net for your family, ensuring wealth creation and realisation of your financial dreams.

Experience peace of mind with a Single Premium Plan that promises protection and guaranteed savings to lay the foundation for a lifetime of financial stability.

Why choose this plan

Learn more about the plan

Eligibility

Age at Entry (Single Life)

Minimum

91 days

Maximum

65 years

Age at Entry (Joint Life#)

Minimum

91 days

Maximum

55 years*

Maturity Age (Single Life)

Minimum

18 years

Maximum

80 years

Maturity Age (Joint Life#)

Minimum

18 years

Maximum

70 years*

Premium Payment Term (PPT)

Single pay

Policy Term (PT)

Minimum

5 years

Maximum

30 years

Single Premium^

Minimum

₹ 75,000

Maximum

No Limit, Subject to Board Approved Underwriting Policy (BAUP)

Sum Assured on Death

Single Life Coverage

1.25 times of Single Premium

Joint Life Coverage

10 times of Single Premium

Income period

NA

All reference to age are based on the age as on the last birthday. Substandard lives may also be covered subject to Board Approved Underwriting Policy and with any extra Premium, if applicable. Taxes as applicable will be charged over and above the quoted Premium.

Boundary conditions for policies sourced through Point of Sales Person (PoSP)

There will be no medical underwriting for policies sourced through POSP channel.

Age at Entry (Single Life)

Minimum

91 days

Maximum

60 years

Age at Entry (Joint Life#)

Minimum

91 days

Maximum

55 years*

Maturity age(Single Life)

Minimum

18 years

Maximum

65 years

Maturity age(Joint Life#)

Minimum

18 years

Maximum

65 years*

Premium paying term

Single pay

Policy Term (PT)

Minimum

5 years

Maximum

20 years

Income period

NA

Single Premium^

Minimum

₹ 75,000

Maximum

Corresponding to maximum Sum Assured on Death of 25 lacs.

Sum Assured on Death

Single Life Coverage

1.25 times of Single Premium, subject to maximum of 25 lacs as per the prevailing PoSP Guidelines, as amended from time to time

Joint Life Coverage

10 times of Single Premium, subject to maximum of 25 lacs, as per the prevailing PoSP Guidelines, as amended from time to time

*Applicable to both the lives

#In case of a Joint life policy:

-

a) The relationship between the two lives can be spouse/ child/ parent/ grandparent/ grandchild/ parent-in-law or sibling. Other relationships may be considered as long as there is an insurable interest between the two lives, which shall be established at the time of issuance of the policy as per our BAUP..

-

b) At the Inception of the Policy, One of the Life Insured must be a major life.

^Single Premium shall be the premium payable by the policyholder at the outset, excluding the taxes, underwriting extra premiums, and discounts, if any.

Premium Band

Single Premium (in ₹)

Band 1

Less than 3,50,000

Band 2

3,50,000 - 7,49,999

Band 3

7,50,000 – 19,99,999

Band 4

20,00,000 & above

Age at Entry (Single Life)

Minimum

91 days

Maximum

65 years

Age at Entry (Joint Life#)

Minimum

91 days

Maximum

60 years*

Maturity Age (Single Life)

Minimum

18 years

Maximum

80 years

Maturity Age (Joint Life#)

Minimum

18 years

Maximum

70 years*

Premium Payment Term (PPT)

Single pay

Policy Term (PT)

Minimum

5 years

Maximum

15 years

Single Premium^

Minimum

₹ 75,000

Maximum

No Limit, Subject to Board Approved Underwriting Policy (BAUP)

Sum Assured on Death

Single Life Coverage

1.25 times of Single Premium

Joint Life Coverage

10 times of Single Premium

Income period

20 | 25 | 30 Years

All reference to age are based on the age as on the last birthday. Substandard lives may also be covered subject to Board Approved Underwriting Policy and with any extra Premium, if applicable. Taxes as applicable will be charged over and above the quoted Premium.

Boundary conditions for policies sourced through Point of Sales Person (PoSP)

There will be no medical underwriting for policies sourced through POSP channel.

Age at Entry (Single Life)

Minimum

91 days

Maximum

60 years

Age at Entry (Joint Life#)

Minimum

91 days

Maximum

60 years*

Maturity age(Single Life)

Minimum

18 years

Maximum

65 years

Maturity age(Joint Life#

Minimum

18 years

Maximum

65 years*

Premium Payment Term (PPT)

Single pay

Policy Term (PT)

Minimum

5 years

Maximum

15 years

Income period

20 | 25 | 30 Years

Single Premium^

Minimum

₹ 75,000

Maximum

Corresponding to maximum Sum Assured on Death of 25 lacs.

Sum Assured on Death

Single Life Coverage

1.25 times of Single Premium, subject to maximum of 25 lacs as per the prevailing PoSP Guidelines, as amended from time to time

Joint Life Coverage

10 times of Single Premium, subject to maximum of 25 lacs, as per the prevailing PoSP Guidelines, as amended from time to time

*Applicable to both the lives

#In case of a Joint life policy:

-

a) The relationship between the two lives can be spouse/ child/ parent/ grandparent/ grandchild/ parent-in-law or sibling. Other relationships may be considered as long as there is an insurable interest between the two lives, which shall be established at the time of issuance of the policy as per our BAUP.

-

b) At the Inception of the Policy, One of the Life Insured must be a major life.

^Single Premium shall be the premium payable by the policyholder at the outset, excluding the taxes, underwriting extra premiums, and discounts, if any.

Premium Band

Single Premium (in ₹)

Band 1

Less than 3,50,000

Band 2

3,50,000 - 7,49,999

Band 3

7,50,000 – 19,99,999

Band 4

20,00,000 & above

Benefits of buying a Signature Wealth plan

This plan provides two Plan Options and helps you customize the plan according to your individual needs. The benefits depend upon the Chosen Plan Option and Coverage type.

Single Life Coverage:

In the unfortunate event of death of the Life Insured during the Policy Term, the Death Benefit shall be higher of:

• Sum Assured on Death (or)

• Death Benefit Multiple^ times Single Premium (or)

• 105% of Total Premiums paid which is Single Premium (Including discount, if any) till the date of death (or)

• Surrender Value as on date of death#

Upon the payment of death benefit, the policy shall terminate and no further benefits shall be payable.

Joint Life Coverage:

On First Death during the Policy Term: Death Benefit payable on first death of any of the lives Insured shall be higher of:

• 1.25 times of Single Premium (or)

• 105% of Total Premiums paid which is Single Premium (Including discount, if any) till the date of death.

Upon payment of above benefit on First Death, the policy will continue for the surviving life Insured

On Second Death during the Policy Term: Death Benefit payable on second death shall be highest of:

• Sum Assured on Death (or)

• Death Benefit Multiple^ times Single Premium (or)

• 105% of Total Premiums paid which is Single Premium (Including discount, if any) till the date of death (or)

• Surrender Value applicable as on date of death#

Simultaneous death of both lives during the Policy Term:

In case of Simultaneous death of both the lives, Death Benefit as mentioned above for ‘First Death’ and ‘Second Death’ shall be

payable, basis the inference that younger life died first.

Upon the payment of death benefit on Second Death, the policy shall terminate and no further benefits shall be payable

Death during Income Period:

In case of Death of the Life Insured or surviving Life Insured (In case of joint life coverage) during the Income Period, Nominee/

Beneficiary shall continue receiving all future payouts as and when due or shall have the option to receive a Lumpsum value instead

of the future payouts which shall be the present value of the future payouts, discounted at 30yr Gsec + 2%. The interest rate shall

be recalibrated at least semi-annually (in April and October) or when the fluctuations in yield is more than 50bps.

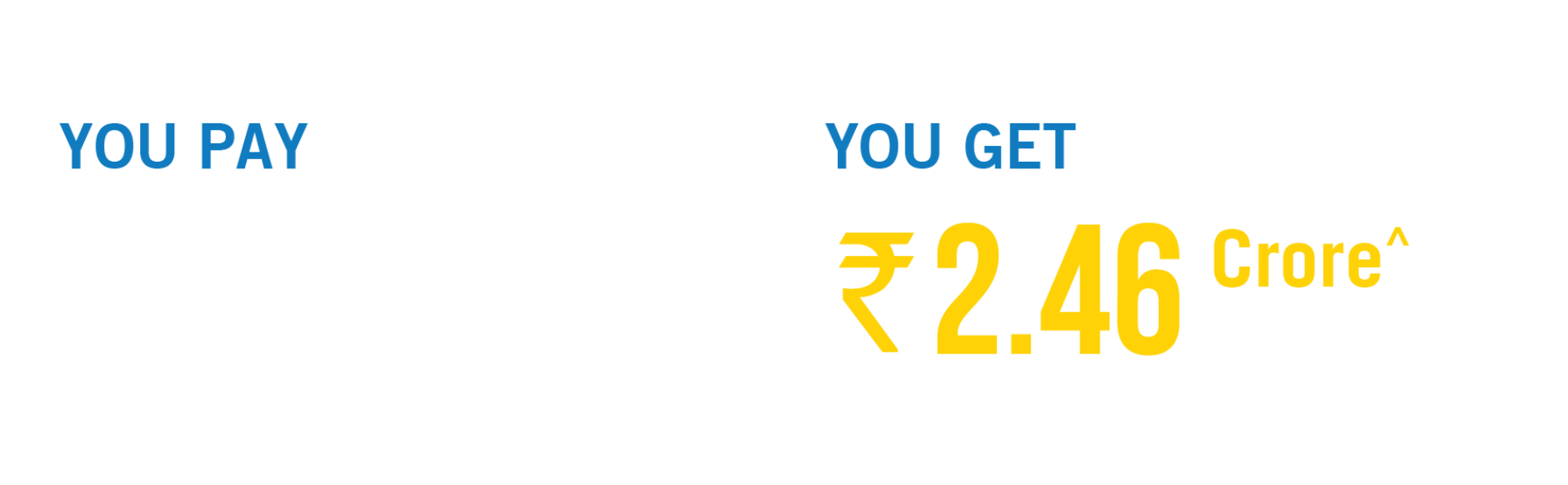

For Plan Option 1 (LumpSum Option): At maturity, The Beneficiary shall receive Sum Assured on Maturity which is a LumpSum amount equal to Guaranteed Maturity Benefit. The policy shall terminate on the payment of maturity benefit and no further benefits shall be payable.

Guaranteed Maturity Benefit defined as a percentage of Single Premium varies on the basis of Chosen Policy Term, Premium Band and Age at entry of both the lives (in case of Joint life).

For Plan Option 2 (Regular Income Option): Maturity Benefit shall be paid in arrears as Guaranteed Income Benefit as per the chosen income pay-out frequency from the end of policy term for the chosen Income Period. The Single Premium shall also be paid back along with last Income Instalment. No further benefits shall be payable after last Income Instalment.

Guaranteed Income Benefit is defined as a percentage of Single Premium varies on the basis of Chosen Policy Term, Premium Band and Age at entry of both the lives (in case of Joint life).

On the maturity date, the policyholder shall have an option to receive the Sum Assured on Maturity, which under this option shall be present value of the future payouts, discounted at a rate of 9.30% p.a. This rate is not guaranteed, however, any change shall be subject to IRDAI’s approval and shall be applicable to new policyholders only.

At any time during income period, the policyholder shall have an option to receive a lump sum value instead of the future payouts

which shall be the present value of the future payouts, discounted at then prevailing 30yr Gsec + 2%.

The policy shall acquire surrender value immediately on payment of Single premium. The policy shall terminate after payment of surrender value and no further benefit shall be payable. Surrender value payable shall be higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV), Please refer to policy documents for details.

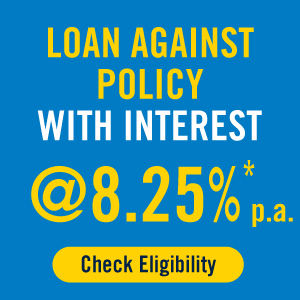

The Policyholder may avail a loan under this policy after the policy acquires a surrender value. The total amount of loan that can be availed shall be limited to a maximum of 75 per cent of the Surrender Value at any time. The Policyholder shall be required to pay interest on the outstanding loan at a rate as determined by the Company from time to time. The rate of interest shall be reset on an annual basis at the beginning of every financial year (April) and will be determined based on the average 10-year G-Sec YTM plus 150 bps rounded down to 25 bps. The average of the benchmark will be taken from the previous financial year for the period 1st July xxxx to 31st Dec xxxx. The source of information for the 10-year GSec rate would be “CCIL”. The current applicable rate of interest on policy loan is 8.75% per annum, which will be applicable for the FY 2025-25.

Premiums paid under this plan may be eligible for tax exemptions, subject to the applicable tax laws and conditions. Income tax benefits under this plan, if any, shall be applicable as per the prevailing Income Tax Laws and are subject to amendments from time to time. Kindly consult a tax expert.

Why choose Pramerica Life Insurance?

Unshakeable life insurance products tailored for your needs

A knowledgeable you is an informed you

Disclaimer:

A Non-Linked Non-Participating Individual Savings Life Insurance Plan

UIN: 140N091V02

This product provides Life Insurance coverage. Goods & Services Tax will be charged over and above the quoted premium. Tax Benefits may be available as per the applicable laws as amended from time to time. This plan offers guaranteed benefits provided the policy is in force and all due premiums are paid in full. Please refer to policy document for further details of the terms and conditions.

.jpg)

.jpg)